This document summarizes Themelio’s “tokenomics” — the incentives and rewards surrounding Themelio’s two built-in tokens, mel and sym.

Two tokens

Themelio has two main built-in cryptocurrency tokens:

- Mel is the default “money” of the blockchain. All fees and protocol-internal incentives are paid out in mel. It is an endogenous stablecoin — a currency that is both fully trustless and can keep a relatively stable value. Mel supply is not fixed, adjusting elastically to demand to keep a stable value.

- Sym is the special-purpose proof-of-stake token. Protocol value accrues to sym, and buying sym is the best way of “investing in the Themelio protocol”. Stakers stake sym to participate in protocol consensus, receiving fees denominated in mel. Unlike mel, sym issuance follows a fixed, bitcoin-like schedule.

Note: the “ticker symbols” for mel and sym are, somewhat confusingly, “MEL” and “SYM”. The relationship between “mel” and “MEL” is analogous to that between “ether” and “ETH”.

The mechanics of how mel is stabilized is discussed in the Melmint document. Here we instead largely focus on the mechanisms that accrue value to sym.

Staking sym for transaction fees

Anybody can stake sym. This consists of locking up sym for a fixed amount of time, designating a particular staker that then receives proportionate voting power in the consensus. (A staker corresponds to a “validator” in many other systems)

Stakers sequentially up/downvote a fee multiplier. This is multiplied by the weight of every transaction to determines the minimum fee it must pay, known as the base fee. Any excess fees are called tips.

Base fees are deposited into a global fee pool. Every staker who creates a new block is then entitled to withdraw a small fraction of this fee pool. The effect of this is to divide base fees in a stake-weighted fashion among all the stakers. Tips, on the other hand, are more like traditional blockchain fees and are paid to only the creator of the block.

A good way of thinking about this is that base fees build up a “trust fund” out of which relatively stable “block rewards” are paid. This gives a similar revenue stream as traditional blockchains to stakers, while ensuring that rewards come from fees and not inflation.

On stake pooling

When locking up sym, any staker can be designated as the staker that receives , not just oneself. This allows an easy form of stake pooling, but there is a crucial difference with most “delegated PoS” systems — designating a third-party staker requires trusting that staker. If the staker gets slashed as punishment for misbehaviour, everybody who designated stake to that staker will get slashed. It is also up to the staker to distribute rewards it receives to people designating it in their stakes, though by default themelio-node does attempt to return staking rewards to people contributing stake.

Sym inflation

As a bootstrap mechanism, we have a small amount of sym inflation in the early years of the protocol that gradually decays to zero, similar to the block reward in Bitcoin.

In particular, we have an initial $2^{20}$ microSYM/block (around 1.04 SYM) inflation rate, that decays by half every 1,000,000 blocks (approximately 1 year).

Unlike in other blockchains, this inflation is not simply paid out as a block reward to the stakers. Instead, it is split between two uses:

- 99.61% funds a mel-denominated pseudo-block-reward. This is by using the sym to buy mel in the Melswap MEL/SYM market. The mel bought is then deposited into the fee pool to be distributed among the stakers.

- 0.39% subsidizes Melmint, by using the sym to buy erg in the SYM/ERG market. The erg bought is then destroyed. This is essentially an “auction” of newly printed sym for Melmint computation, bootstrapping a small amount ofactivity in the Melmint mechanism.

Staker income summary

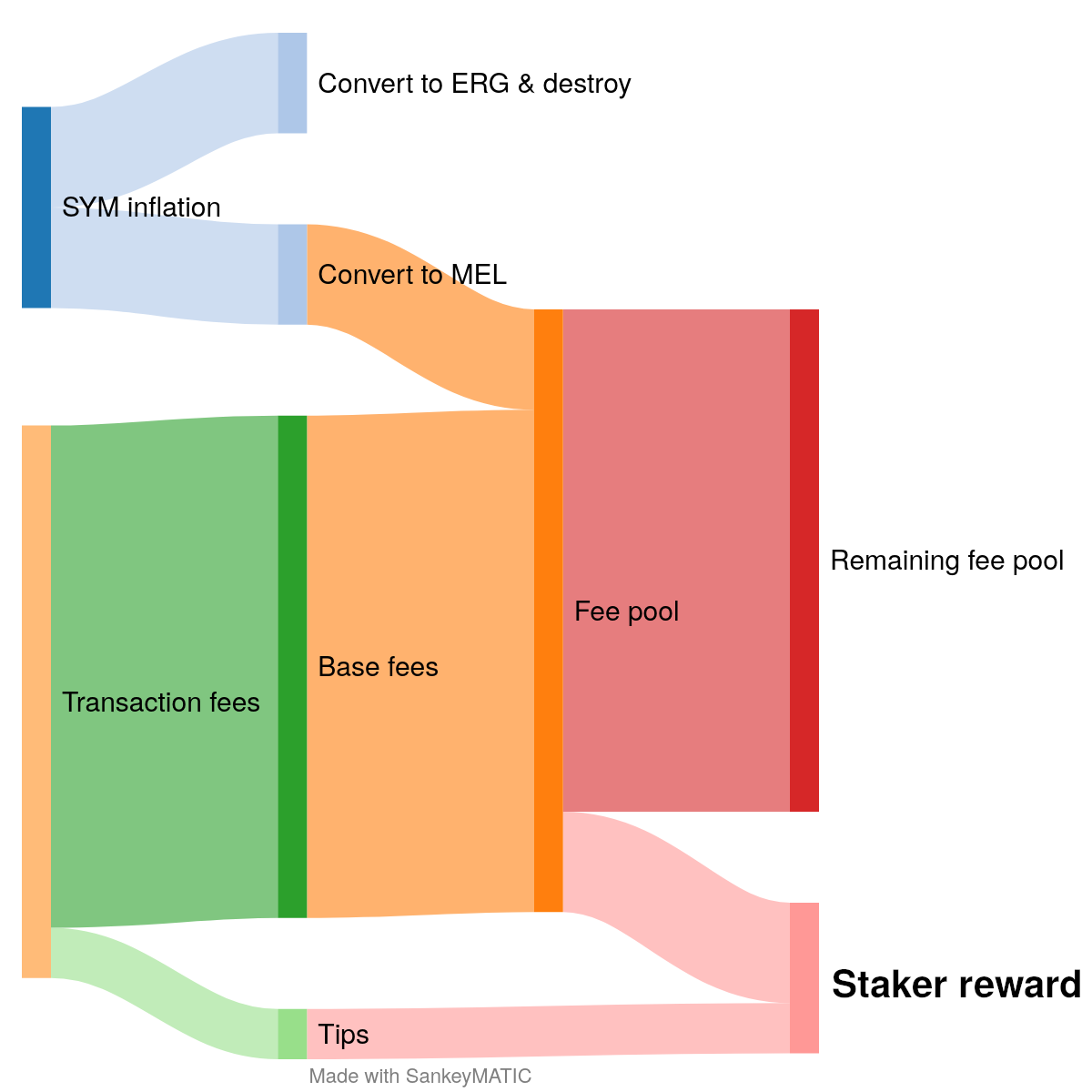

The following Sankey diagram summarizes the entire MEL-denominated “block reward” of a staker: